How to raise a card dispute.

This article will explain what is meant by a dispute and how you raise one if you needed to.

What is a dispute?

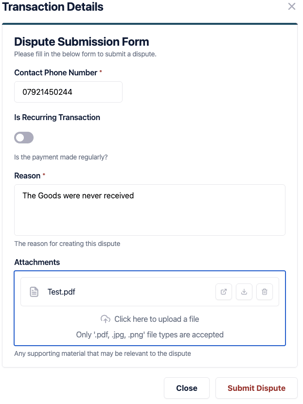

“A card dispute, also known as a chargeback, is a process where a cardholder disputes a transaction on their credit or debit card statement. This could be due to fraud, incorrect charges, or unsatisfactory goods/services. The cardholder asks their bank to recover the funds from the merchant.

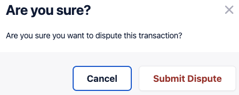

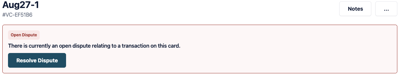

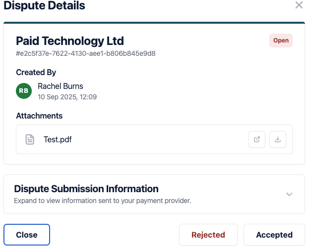

The first step would be to contact the merchant directly to resolve the issue. If that fails, you can start the dispute process on Paid. Please follow the guide below, this will then be investigated by your issuing bank, and if successful the money will be returned and allocated onto the card itself. Please be aware that this process takes time.”

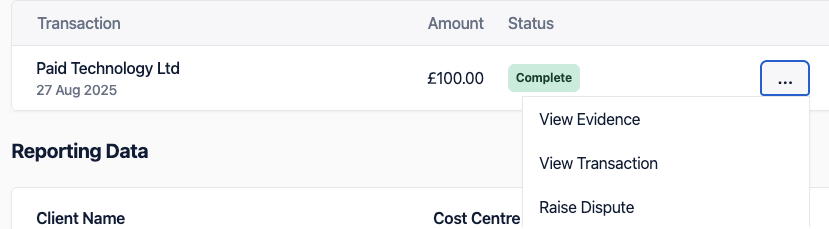

Please note raising a dispute is not to be used to provide evidence for the transaction, should this window be closed please contact your administrator.

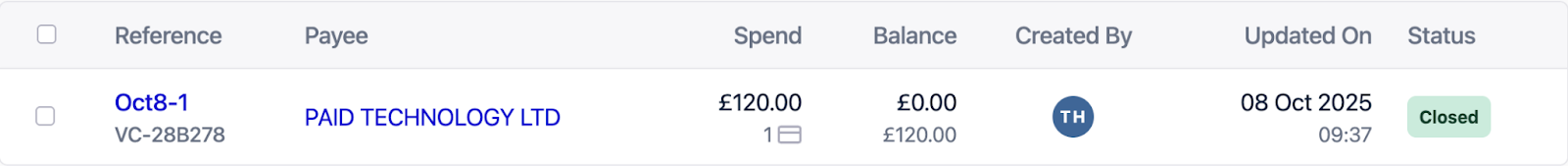

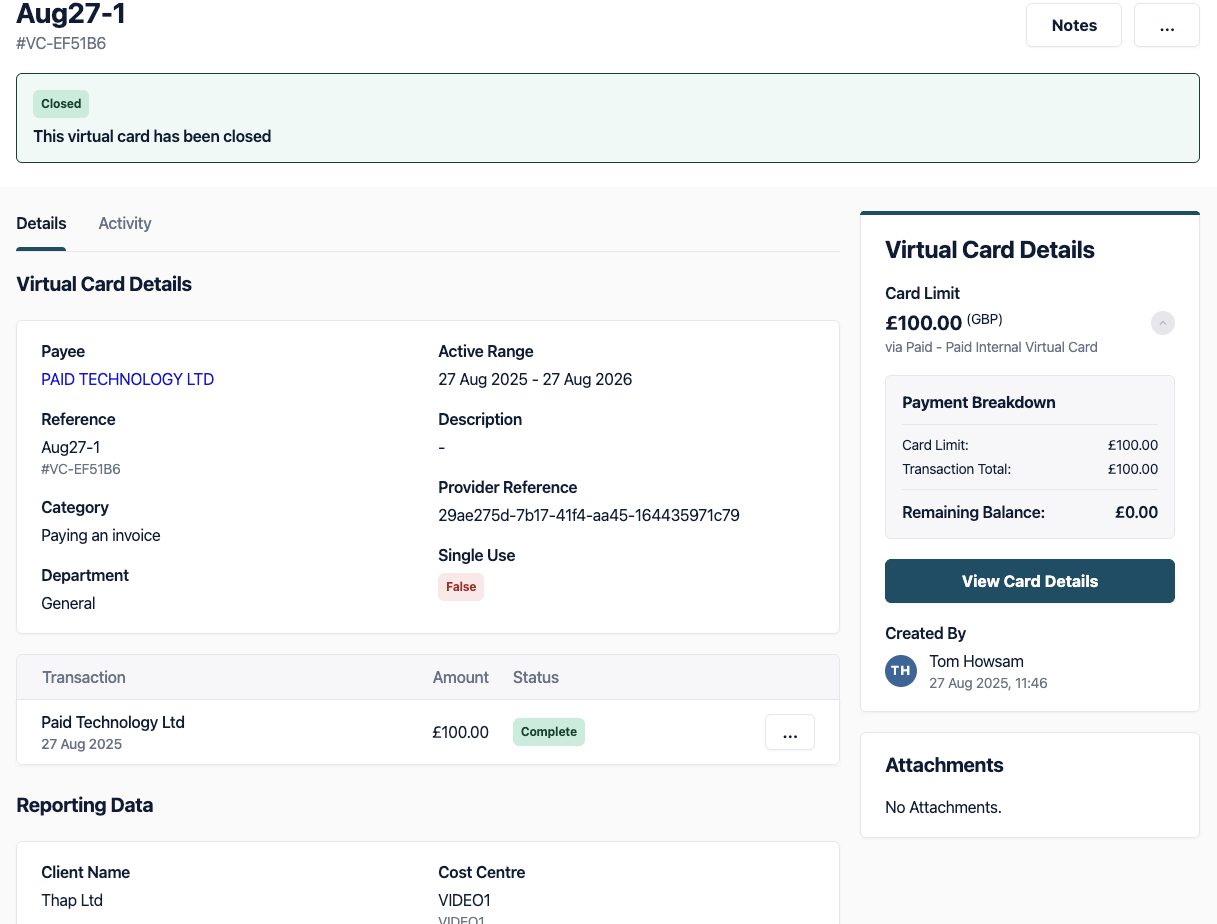

1) Go into the list of Virtual Cards, you can navigate to this from the menu on the left hand side;