How to assign tax to evidence

This article will teach you how to assign the correct tax/VAT to your evidence.

This guide assumes you have access to the card you want to upload the evidence to.

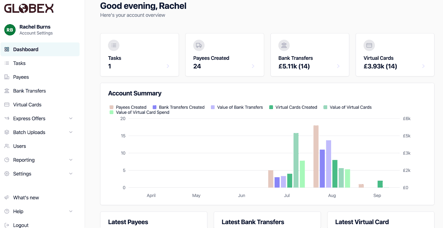

1) Log into your dashboard;

![]()

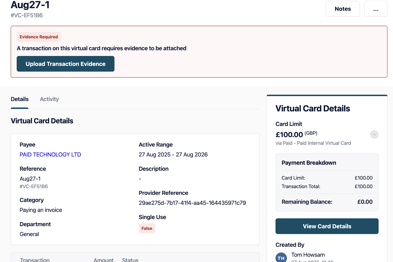

and in the task lists;

![]()